Your Career Journey: Dealing with Personal Tax – Part 1

Introduction

Two things in life are certain… Death and taxes! We so easily shrug off this statement. But, the reality is that dealing with personal tax can be a real struggle.

In this two-part blog post, a local tax and consulting business, Kael Consulting Inc, weighs in on the reasons around why we need to pay personal tax.

Why Do We Pay Tax?

Let’s set the scene…

“Congratulations, you’ve got the job. Can you start on…?”

Applying for your first job is an exhilarating roller coaster ride. From the stress and anxiety of the interview, to the absolute excitement of earning your first month’s salary! With your appointment into your new position, you immediately celebrate the first step on your career journey and mentally start spending the long-awaited salary…

Finally, payday arrives! However, your bank balance reflects a little less than you anticipated. As you examine your payslip to ensure everything is in order and you spot a line item, “4102 – Pay As You Earn (PAYE).” You have received your salary LESS tax!

What is tax? And why do we have to pay tax, anyway?

Income sources for government

The government derives income from various taxes that it levies. For example:

- Pay As You Earn (PAYE)

- Value Added Tax (VAT)

- Capital Gains Tax (CGT)

Most of the government’s income is derived from income tax. Income tax is made up of:

- personal income tax (from individual taxpayers, like you and me)

- company income tax (from businesses)

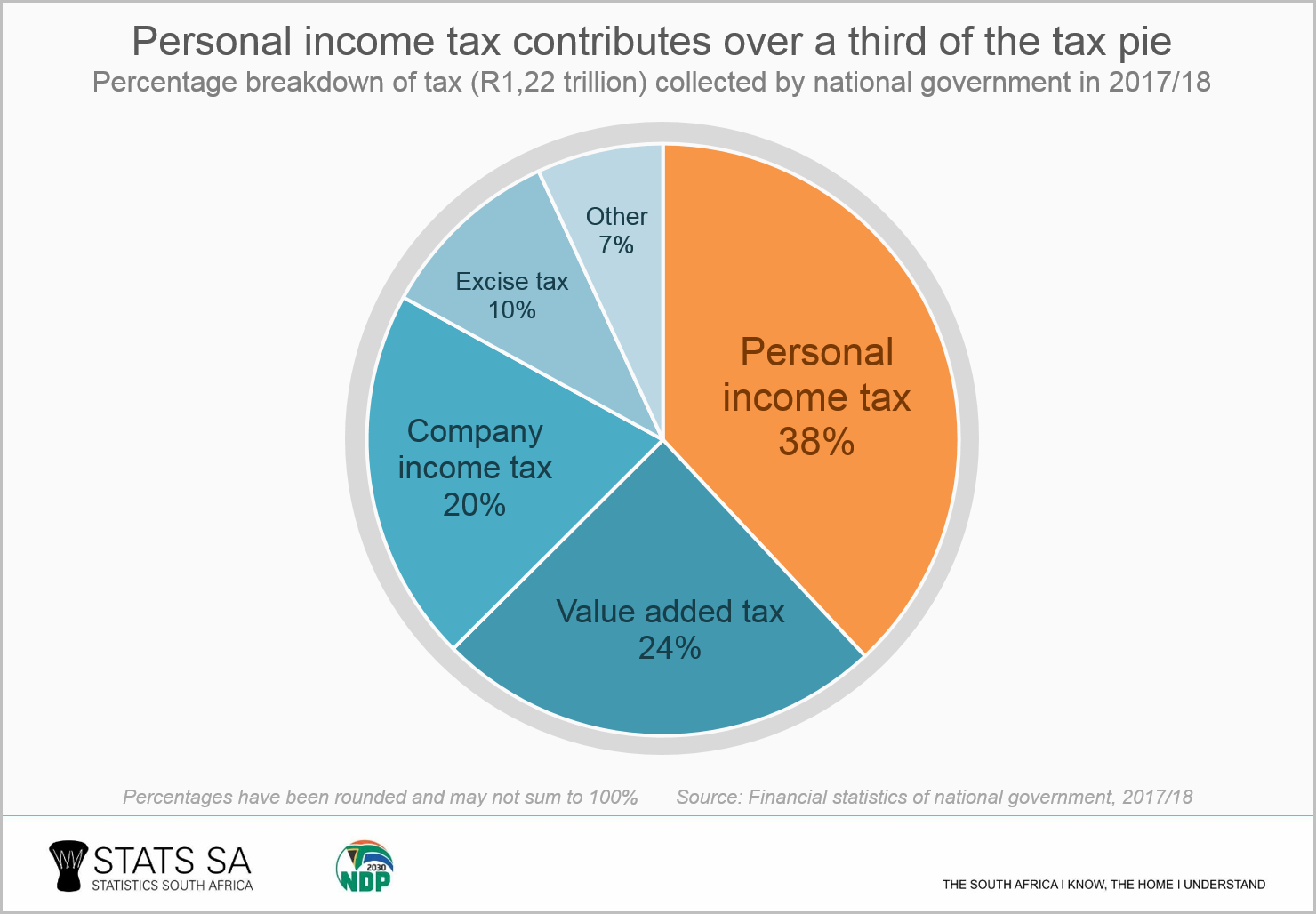

The following pie chart from Stats SA shows that personal income tax contributes a large portion of the taxes collected by government.

Public services

The income derived from the various taxes are used to provide numerous public services. So, in February each year, the Finance Minister presents his annual budget speech. During this speech he provides a detailed breakdown of the expected tax and expenditure for the year.

Some of the public services provided include:

- Education – government funded schools

- Defence, public order and safety – e.g. South African Defence Force and South African Police Services

- Health care – Clinics and Government Hospitals

- Social protection – Department of Social Development, SASSA Grants, foster grants, pension grants, etc.

The PAYE deducted from our salaries therefore contributes to the provision of these services.

Payroll tables

Every year the Budget is presented and approved, and SARS then issues Payroll Tables for the following tax year. Let’s explain these terms:

- A financial year runs from 1 March to 28/29 February.

- Therefore, the 2020 financial year runs from 1 March 2019 to 29 February 2020.

- The Payroll Table sets out the tax brackets, which shows salary ranges and the corresponding tax percentage that applies.

These Payroll Tables therefore determine how much tax will be withheld from your payslip. It works on a sliding scale. In other words, the more you earn, the higher your tax percentage will be.

Conclusion

In conclusion, without our personal tax, government won’t be able to provide crucial public services.

In part two of this blog post Kael Consulting Inc will explain the process around completing and submitting a personal income tax return.

About Kael Consulting

At Kael Consulting, our vision is to partner with our clients – to help them achieve their business goals. We are progressive and innovative and we are constantly looking for better, more efficient ways of providing accounting and taxation services to our clients.

Port Elizabeth is exceptionally entrepreneurial and we have had the privilege of working with individuals, start-up businesses and businesses further along their journey, which has been very exciting.

Contact Kael Consulting on:

- Email: [email protected] or [email protected]

- Phone: 041 373 2103

- Web: www.kael.co.za

- Facebook: Kael Consulting Inc